Since the outbreak began on the 31st of December 2019, Stocks and shares have taken a large hit, and the value of pensions and ISAs have been greatly effected, This prompts many investors to fear that the impact of COVID-19 will effect the economy on such a large scale that governments will be incapable of stopping the decline.

Examples of where the economy is taking hits can be found in the prices of oil where on the 27th of April they hit the lowest price for the last 21 years, However technology and video sharing apps have actually seen a rise in customers with the video call app ‘zoom’ seeing a rise of 131.1% in usage.

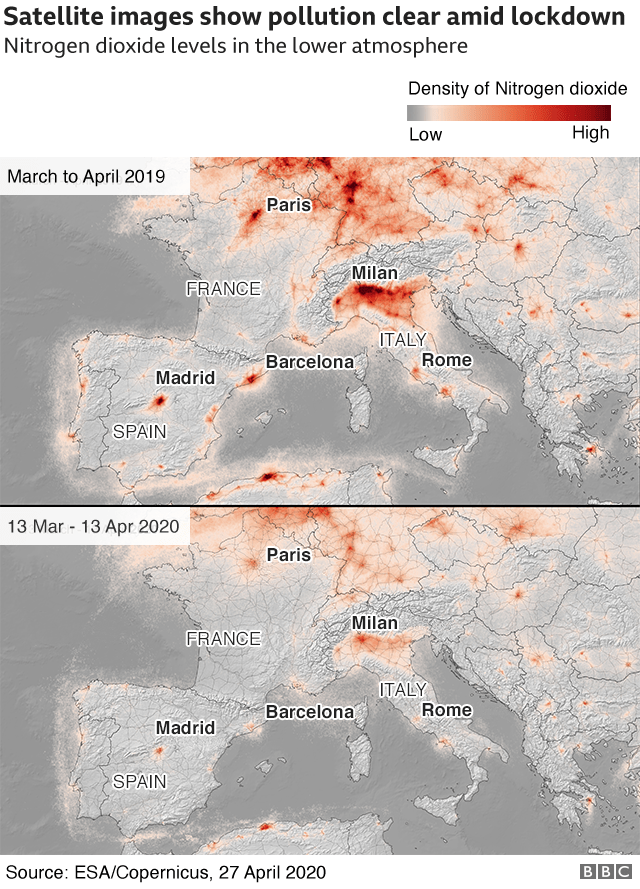

Moreover a decrease in travel and ban from tourists from particular countries, although particularly damming for travel and holiday companies, reduces pollution and air contamination globally, a generally positive effect for global warming and Climate change.

A Guardian writer Dennis Leach, argues that the prediction of an economic crash and recession following COVID-19 is unrealistic, by looking at history we can see that the ‘second world war did not lead to recession and unemployment thanks to Keynesian policies of a labour Government’.

Keynesian economic theories, revolve around low tax and increased government expenditure to stimulate demand for an economy, Arguing that economic output is heavily influenced by different factors influencing demand.